The Oil Paradox: Why Today's Prices Could Turn into a Crisis.

Harold Hamm, the founder of Continental Resources, states that American shale oil producers are facing many challenges due to falling prices. He notes that this leads to a reduction in drilling new wells.

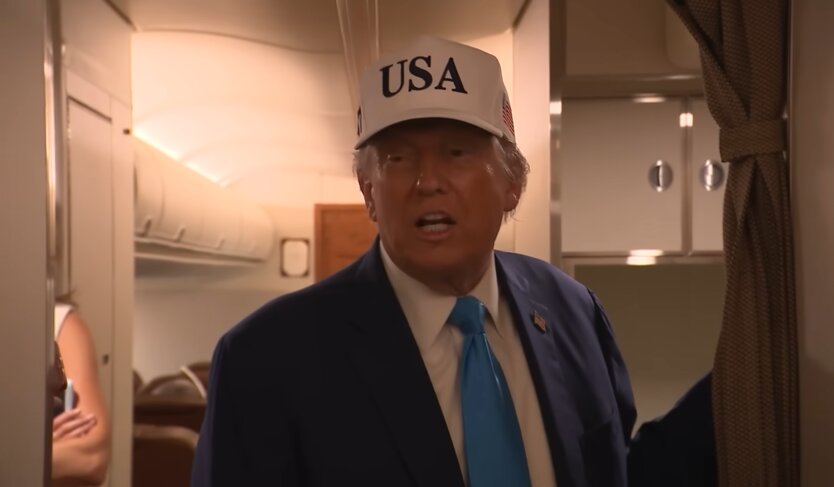

'When the price of supply becomes lower, you can't 'drill, drill, drill'' - says Harold Hamm.

The founder of Pioneer Natural Resources also urges caution in increasing production due to rising costs and falling prices. He warns of potential denial of oil reserves.

However, the current price situation may positively affect the availability of some fields. With rising prices, they may become more profitable for extraction, reducing risks for the industry.

The USA and Canada are among the largest producers of oil and gas, but the current price situation could threaten their strategic security and competitiveness.

The problem also lies in the absence of external buyers. Countries that previously bought treasury securities are now selling them or stopping purchases. There is also a shortage of foreign investors, leading to rising interest rates.

Analysts believe that the optimal price for oil for the USA should support domestic production, prevent sharp price increases, and help achieve financial goals. A significant drop in prices could lead to industry contraction and rising prices and tariffs in the future.

Read also

- Trump announces negotiations with China regarding the TikTok deal

- Putin wants to go all the way and kill people: Trump commented on the conversation with Zelensky

- Enemy losses as of July 5, 2025 – General Staff of the Armed Forces of Ukraine

- The US is sabotaging Trump's peace plan: expert names the culprit in the Pentagon

- Ukraine Awaits a Summer of Ruthless Attacks: WSJ Reveals Putin's New Plan

- Response on 'Shahedi': The Armed Forces of Ukraine struck a key defense industry facility in the Moscow region