NBU: the 'eOselya' program hinders the development of the market mortgage in Ukraine.

In the stability report for December, the National Bank of Ukraine states that the 'eOselya' program is the only mortgage lending option that has displaced commercial offers.

Banks cannot compete with this program due to its preferential conditions. Therefore, more than 90% of mortgage loans are issued through 'eOselya', and three state banks - Oschadbank, PrivatBank, and Ukrgazbank - hold the majority of the market.

The situation in the mortgage market remains complicated. In the first half of the year, only 5% of transactions were made using mortgage loans, and then this figure dropped to 4%. Almost half of the loans were granted for properties in Kyiv and the Kyiv region. Buyers avoid the primary market due to its lack of transparency.

The National Bank believes that government support programs need to be revised. The regulator proposes to use market mechanisms to form interest rates and to support only those who truly need credit. This applies to both the 'eOselya' program and the 'Affordable loans 5-7-9%' program.

Read also

- The General Staff responded to Russia's statement about a breakthrough in Dnipropetrovsk

- Ukrainians warned about a new massive attack from the Russian Federation: Kyiv and 8 other regions at risk

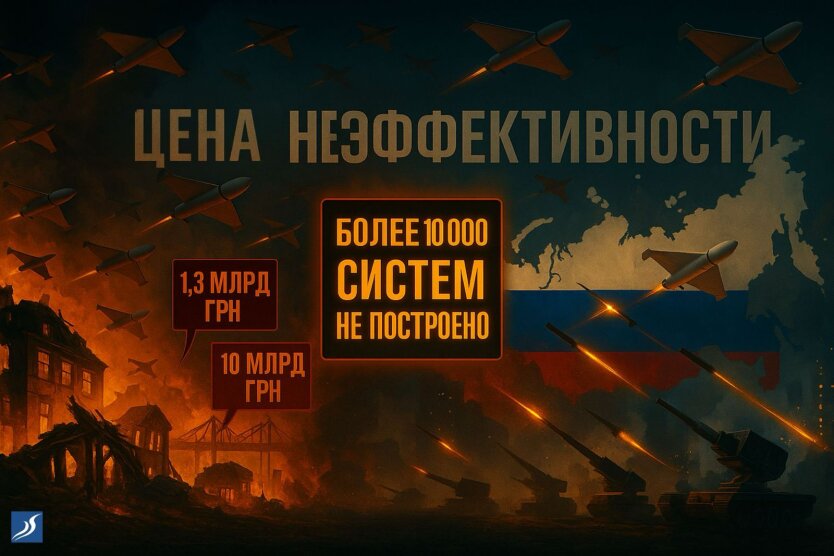

- The Cost of Inefficiency: Large-Scale Russian Attacks Require Large-Scale Organizational Responses from Ukraine

- War may come to us: the head of the Czech Republic issued a troubling warning

- Zelensky: The USA unexpectedly sent missiles intended for Ukraine to another country

- Zelensky said where Trump sent the 20 thousand missiles promised by Biden